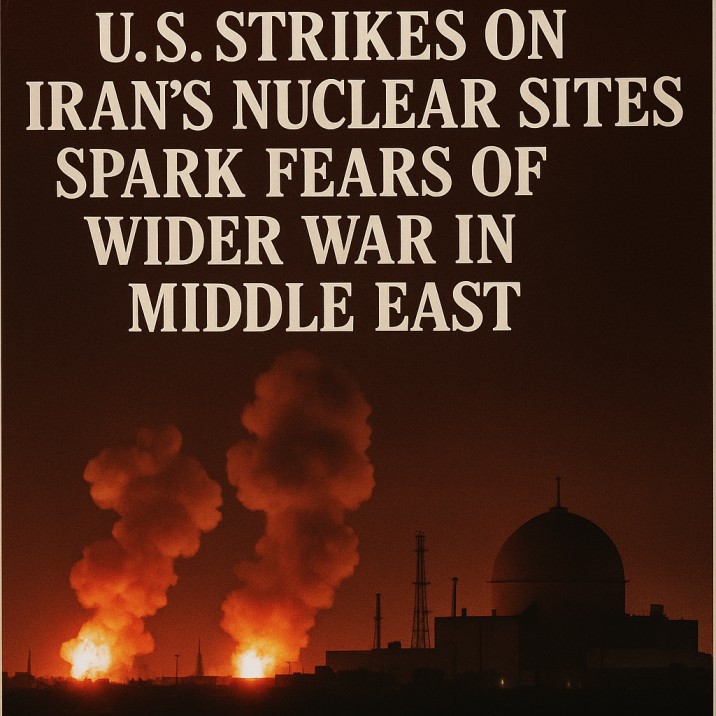

What Happened: The eruption of war in the Middle East (see Story #1) is sending shockwaves through global financial and commodity markets, driving oil prices sharply higher and raising fears of renewed inflation. In June 2025, the price of Brent crude oil – the world benchmark – has jumped about 20%, on track for its biggest monthly spike since 2020. From under $65 per barrel in late May, Brent has surged into the mid-$70s, briefly touching $80 on war headlines. Traders are nervously watching every twist in the Israel-Iran conflict, which threatens to disrupt oil flows from a region that still supplies a significant share of the world’s crude. While there is no immediate oil shortage (so far no major facilities have been attacked, and key shipping lanes remain open), markets are pricing in the risk that the situation could worsen suddenly. The war risk comes just as the world was enjoying a period of relatively moderate energy prices and easing inflation. Now, policymakers fear an unwelcome replay of the 1970s-style energy shock or the sharp price spike seen after Russia’s Ukraine invasion in 2022.

Why Oil Is Climbing: The Strait of Hormuz – a narrow passage between Iran and Oman – is a particular chokepoint of concern. About 20% of global oil consumption flows through Hormuz via tanker ships. With Iran and the U.S. now in direct hostilities, analysts worry Iran could attempt to close or threaten the strait in retaliation, as it has in past showdowns. Any disruption to Hormuz could push oil well above $100 a barrel quickly, traders warn. Even short of that extreme, there are fears of attacks on oil infrastructure: Iran has ballistic missiles and drones that could target Saudi or Emirati oil fields, and Israel might strike Iranian export facilities. Investors have responded by adding a “war risk premium” to oil prices. One indicator, the price difference between near-term oil contracts and futures six months out, widened to a six-month high – a sign that traders expect tighter supply or higher demand in the very short term due to the crisis. Notably, this surge is more precautionary than panicked: oil is still far below the peaks seen in previous crises (Brent hit $139 in early 2022). As ABN AMRO’s chief investment officer put it, “If oil goes into the $80-100 range and stays there, that jeopardizes the global economy… We are just below that threshold.” That threshold may soon be tested if the conflict escalates further.

Wider Market Impact: The oil shock has already caused a ripple effect. Stock markets worldwide have wobbled in recent days as energy and defense stocks rise while airlines and other fuel-sensitive sectors fall. Safe-haven assets like gold have ticked up, reflecting investor anxiety about geopolitical instability. In bond markets, an initial rally (as investors sought safety in government debt) was reversed by inflation worries – higher oil prices could push consumer prices up, complicating central banks’ efforts to tame inflation. Indeed, market-derived inflation expectations have crept upward in June. For instance, breakeven inflation rates (the bond market’s gauge of expected inflation) rose by a few tenths of a percent in the U.S. and Europe over the past two weeks as oil climbed. Some economists now warn that the U.S. Federal Reserve and European Central Bank might face pressure to maintain higher interest rates for longer if energy costs feed into broader price rises.

Energy Supply and OPEC+: A key factor containing the price spike (so far) is that actual oil supply hasn’t been significantly disrupted yet. OPEC+, the alliance of major oil producers led by Saudi Arabia and Russia, has spare capacity and has been in a mode of cutting output this year to prop up prices. Ironically, before the war news hit, oil prices were quite low due to abundant supply and worries about weak demand; OPEC+ had even announced further production cuts to fend off a glut. Now, those production cuts might be a buffer: OPEC+ could quickly reverse course and pump more if needed to calm markets. However, one potential complicator is Iran’s own oil exports. Iran had been exporting oil at increasing volumes (often under the radar, due to U.S. sanctions) in recent years. If the conflict and U.S. strikes damage Iran’s oil infrastructure or lead to tighter enforcement of sanctions, a few hundred thousand barrels per day of Iranian crude could be effectively removed from the market. On the positive side, other producers like the U.S. have room to increase output (U.S. shale producers might respond to sustained $80+ prices). And importantly, China – the world’s biggest oil importer – has not shown panic buying yet. Analysts note that if China’s state refiners start aggressively stockpiling oil due to war fears, freight rates for tankers would spike and prices could shoot up further. So far, Chinese buying has been steady, indicating a wait-and-see approach.

Economic Jitters: Higher oil acts like a tax on consumers and businesses, potentially hurting economic growth if the spike is sustained. Economists at Lombard Odier estimate that if crude stays above $100, global growth could be shaved by about 1% and inflation would be 1% higher than otherwise. That is a significant hit, given many economies are growing in the low single digits. Europe and Japan, which import most of their energy, are particularly vulnerable. The European Union has already faced high inflation and was enjoying relief from lower gas and oil prices earlier this year; a renewed surge could squeeze households again and complicate the ECB’s rate decisions. In developing countries like India (which imports ~85% of its oil) higher crude costs can widen trade deficits and weaken currencies. India’s government is watching carefully – it has so far not raised retail fuel prices (possibly waiting to see if the spike is temporary), but prolonged higher oil would either mean pump price hikes or a subsidy burden. In the U.S., where inflation had been steadily cooling, gas prices are now edging up again, a potential headache for President Biden (or in our timeline, President Trump) and the Fed.

Outlook: Much depends on how the Middle East conflict unfolds. If there is a ceasefire or de-escalation in coming weeks, oil prices could quickly retreat from current highs, as the underlying market was well-supplied and even somewhat soft prior to the war. In fact, some traders are betting that this oil rally will be short-lived, noting that global demand growth is modest and other sources (like Venezuela or U.S. shale) can fill gaps if prices stay high enough. On the other hand, a widening war could send prices spiking further – and unpredictably. Markets vividly remember 2022, when Russia’s invasion of Ukraine caused a sudden leap to nearly $140 per barrel, only for prices to then seesaw as countries adjusted.

One interesting dynamic is the weakening correlation between oil and the U.S. dollar observed this month. Usually, higher oil goes with a weaker dollar (as petrodollars flow and U.S. inflation fears rise), but in June both oil and the dollar index rose together at times. Analysts say this is because the U.S. economy is viewed as relatively resilient to an oil shock (thanks to its own oil production gains), so investors have still sought dollars as a safe haven even as oil climbed. However, if oil marches well past $80, all bets are off – it could re-ignite talk of stagflation (stagnant growth + high inflation) reminiscent of the 1970s.

For now, consumers are feeling a bit of pinch at the pump again. Gasoline prices in the U.S. have risen perhaps 5-10% over the month. European natural gas prices also jumped, partly in sympathy with oil and partly on worries Iran might disrupt shipping in the Persian Gulf that includes LNG. Central bankers, who only weeks ago were considering pausing interest rate hikes, now must weigh whether an oil-driven inflation bump is coming.

In summary, the Israel-Iran war’s “second-order effect” on the global economy via oil prices is a developing story. It underscores how geopolitical risks can swiftly derail economic calm. Policymakers from Washington to Riyadh to Beijing are all, in a sense, hostage to what happens next in the Middle East – hoping for the best, but preparing contingency plans for an oil supply shock that everyone prays won’t materialize.